The financial epidemic is on the rise in the United States, and only a few seem to be concerned. The latest ALICE, Asset Limited, Income Constrained, employed reports show that 27% of Pennsylvanians earn above the Federal Poverty Level but not enough to afford basic household necessities. Necessities include childcare, utilities, food, and clothing. If an unexpected disaster such as car repairs, broken appliances, or health issues should occur, the results could be disastrous. If we bring the statistics closer to home, Lehigh County is at 47% below the Alice threshold. Think about those numbers for a moment. These are our neighbors, coworkers, family members, and friends. We can help this vulnerable population in our community. We need to attract new partners, stimulate meaningful conversations, and create strategies for conclusive change.

With the cost of living surpassing our wages, our household survival budget reflects the bare minimum. In the United States, more than half of our population has less than three months of savings to cover their necessities. In addition, we have inadequate retirement savings, excessive student debt, or no plan at all for either of these future goals. As a result, we have to make tough choices, such as deciding between quality childcare or paying the rent, which have long-term consequences.

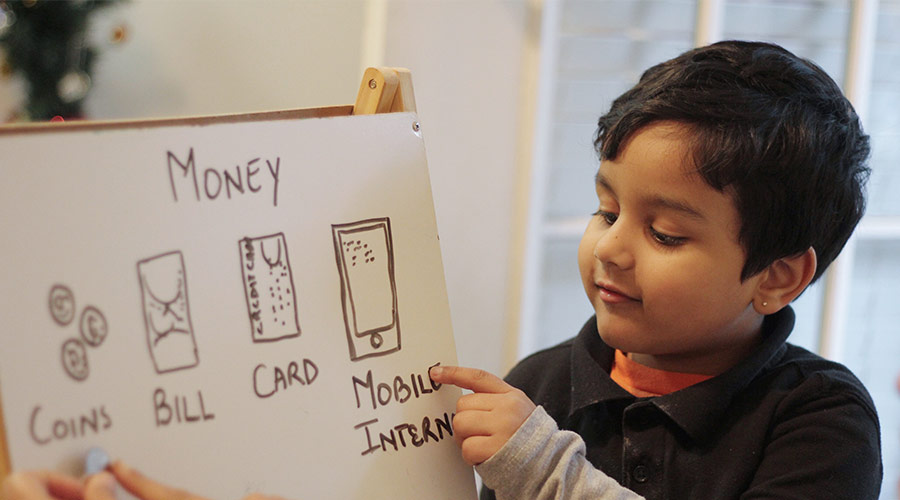

Some of our meaningful conversations need to include financial awareness so we can provide our neighbors, coworkers, family members, and friends with the set of skills that allow them to make informed and efficient decisions with all their financial resources. Financial literacy is an excellent equalizer. Teaching students how to have a healthy relationship with money and healthy spending habits are the foundation for improving our community’s wealth gap. Sadly, Pennsylvania is one of the states that does not require schools to have a financial education curriculum to graduate.

Financial literacy works the same in every socio-economic background. But unfortunately, the lack thereof negatively impacts the quality of life for so many Americans. It transcends race, ethnicity, and gender. So why are we not preparing our kids to become financially literate adults? We need to pressure our school districts and politicians to include financial literacy in the education system immediately. On January 8, 2022, President George W. Bush signed the “No Child Left Behind Act.” Many children have been left behind without financial literacy, considering this law a failed experiment. We need to expand on our former president’s amended Act of Adult Education and Family Literacy Act with an updated action plan. Our financial lives matter! We can no longer sit back and leave our nation ill-prepared for life.

The Valley Wealth Alliance is a 501(c)(3) organization based in Allentown, PA. The organization’s mission is to provide resources and programming to help educate the lower-income community on why financial literacy is essential in breaking the cycle of generational poverty. Through in-person group sessions, community events, and one-on-one counseling, you will gain confidence to achieve longterm goal setting, leading to financial security. If you are interested in mentoring, volunteering, or donating to our cause, visit www. valleywealthalliance.org. Let’s join forces in being crusaders of economic justice!